Payment Gateways Compared: Which one to choose for your business

Not all payment gateways are created equal and the wrong choice could be costing you customers. With online shoppers expecting fast, seamless transactions, finding the best gateway is crucial for maximizing conversions.

For online stores, the checkout moment is where the magic happens or falls apart - and eCommerce payment gateways play a big role. With almost 70% of online shoppers abandon their cart. eCommerce sites should double their effort to create the perfect checkout experience and improve the conversion rate. But...Where to start?

A seamless, secure, and simple checkout with the right eCommerce payment gateway is where to start. We have reviewed six different headless eCommerce payment gateways so we can walk you through the best payment gateway solutions available today and show you exactly how to optimize your checkout to keep shoppers clicking that buy button.

Key takeaways

- Choosing the right payment gateway will help reduce cart abandonment, builds trust, boosts conversion rates, and expands global reach.

- Key features to look for in a payment gateway: Security (PCI DSS compliance), fraud protection, multi-currency support, recurring billing, and seamless API integration.

- Most popular gateway options: Stripe, Bolt, Adyen, Square, and Braintree offer different benefits like fast checkout, multi-channel payments, and competitive pricing.

- Optimize checkout for better conversions with streamlined steps, multiple payment options, display security badges, support mobile commerce, and use exit-intent popups.

On this page:

What is a Payment Gateway?

A payment gateway is a technology that eCommerce sites use to securely capture and transfer payment information from customers to their bank. It’s the bridge between your online store and the financial institutions involved in a transaction.

An optimized payment gateway can significantly improve conversion rates, protect against fraud, and create a seamless shopping experience.

Why Choosing the Right Payment Gateways Matter for eCommerce

Checkout process is the most crucial step for every e-commerce store. It's impact on conversion rates, trust-building, and customer loyalty, with studies showing nearly 70% of online carts abandoned due to checkout friction. Here’s why it matters:

Reduces Cart Abandonment

A slow or complicated payment process is one of the leading causes of cart abandonment. A trusted and efficient payment gateway reduces friction and recovers lost sales.

Builds Trust and Credibility

Reputable payment gateways signal to customers that their financial data is safe. Secure payment icons, SSL certificates, and brand familiarity increase confidence.

Boosts Conversion Rates

A smooth checkout experience combined with multiple payment methods (credit cards, wallets, BNPL) caters to diverse user preferences.

Expands Global Reach

Multi-currency support and local payment methods help businesses scale internationally.

Improves Mobile Commerce

With over 70% of eCommerce transactions happening on mobile, your payment gateway needs to be mobile-optimized

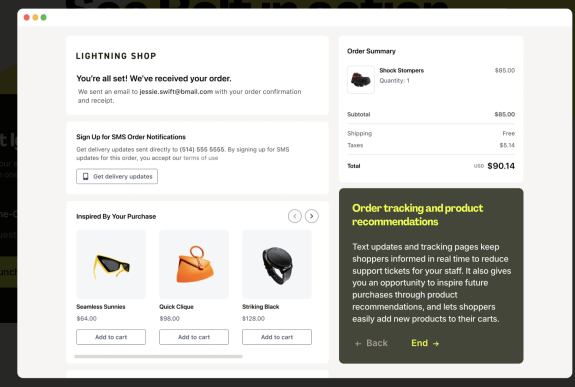

Critical Checkout Components

A well-designed process typically includes:

- Cart Review: Clear item summaries and easy editing.

- Guest Checkout: Avoids forced account creation.

- Shipping Transparency: Real-time cost calculators and delivery estimates.

- Payment Flexibility: Options like Apple Pay, PayPal, and Buy Now, Pay Later.

- Confirmation: Instant email receipts with order details.

Key Features of a Good Payment Gateway (And Why They Matter)

Choosing the right payment gateway comes down to more than just processing transactions. It’s about trust, security, scalability, and customer convenience. Here are the key features you should look for — and why they truly matter:

- PCI DSS compliance: Ensures that your business adheres to strict security standards for handling cardholder data, protecting both the merchant and customer from data breaches and fines.

- Fraud detection and risk management: Advanced fraud prevention tools help identify suspicious transactions and protect your business from chargebacks and fraudulent activities.

- Multi-currency support: Allows your business to accept payments in various currencies, opening doors to global markets and providing convenience for international customers.

- Recurring billing options: Essential for subscription-based businesses, enabling automatic billing cycles and reducing manual intervention.

- Fast settlement: Quick transfer of funds from transactions into your business account improves cash flow and allows for smoother business operations.

- Seamless API integration: A developer-friendly API ensures that the payment gateway can be easily customized and integrated into your existing website or mobile app for a fully branded and smooth checkout experience.

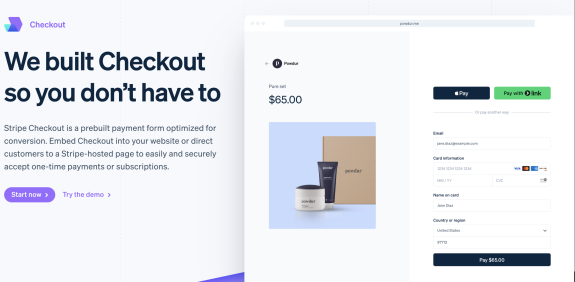

Stripe

Stripe is one of the most popular online payment processing platform. It works well, its intuitive and it can be installed quickly. With Stripe, merchant can accept credit cards, debit cards, and bank transfers. With its free API, developers can integrate

Stripe checkout with any headless commerce and into their apps. Stripe accepts all major credit card and has a an online payment fee of 2.9% plus 30 cents per transaction.

| Pros | Cons |

|---|---|

| Flat-rate, transparent pricing with no setup, cancellation or monthly fees. | Open API and tools may be difficult to use without software development expertise. |

| Supports a wide variety of payment methods and currencies. | Limited functionality for in-person retail businesses and restaurants. |

| Highly customizable checkout flow. | |

| 24/7 customer support via phone, email and live chat. | |

| Easy and quick to setup. |

Bolt

Bolt is a new player in the market but already making a name for itself. It building one-click checkout for everyone. It's an easy solution to setup one-clik checkout on your ecommerce website. It offers an extensive list of features, including support for multiple languages, currencies and payment types.

| Bolt Pros | Bolt Cons |

|---|---|

| Fast checkout with its minimal customer input Bolt can offer a one click checkout option. | Daily settlement report could be improved for reconciliation. |

| Robust fraud protection with 100% fraud coverage. | Higher price point compared to other options. |

| Advanced merchant dashboard. | |

| 24/7 customer support via phone, email and live chat. |

Ayden

Adyen is an established european payment gateway. it is a fast, secure and developer-friendly way to accept payments anywhere, on any device or channel. It supports all major credit cards, as well as Apple Pay, Android Pay, and other mobile wallets. It also offers a wide range of features for developers, including a REST API and SDKs for various programming languages.

| Ayden Pros | Ayden Cons |

|---|---|

Multi-channel payments: online, in-store payments, mobile payments, and more. | Complex pricing structure. |

| 24/7 customer support via phone, email and live chat. | Minimum invoice amount required. |

| Built-in risk management tool. | Limited features for brick and mortar. |

| Accepts more than 250 payment methods. | |

| No monthly setup, integration or closure fee. | |

| Test account available. |

Square

Square is a popular payment processing for small and medium sized businesses.Their suite of include POS systems, invoicing, and eCommerce. It also provides an online payment gateway that supports credit card and ACH payments.

| Square Pros | Square Cons |

|---|---|

| No monthly fee for basic plan. | Not ideal for enterprise or high volume transactions. |

| Free swipe card reader. | No phone support. |

| POS features with customer directory, reporting and inventory management. | Account stability issues |

| Customer support Monday to Friday for free plans - 24/7 for premium plans. | |

Low, predictable fixed-rate at 2.6% + $0.10 per swipe |

Braintree

Braintree is a subsidiary of PayPal and allows businesses to accept credit cards, debit cards, PayPal, Apple Pay, and Android Pay. It has a lower transaction fee than Stripe (2.2% + 30 cents per transaction) and also provides a free API for developers.

| Pros | Cons |

|---|---|

| Customizable UI | Overpriced gateway-option only |

| Predictable and competitive flat rate pricing | Long setup times |

| Extensive integrations available | |

| Multi-currency options | |

| Developer access to backend | |

| Easy functionality |

Now that you have all the details to choose your checkout and payment solution, here are a few tips to optimize your customers checkout experience:

10 steps to improve your checkout experience

1. Eliminate unnecessary steps and make it easy for customers to find the information they need. Amazon has made the 1 click-checkout famous and for a good reason. You can also use Google auto-address for adding the shipping address.

2. Offer multiple payment options, including credit cards, PayPal, and other popular methods. The more options you give your customers, the easier it would be for them

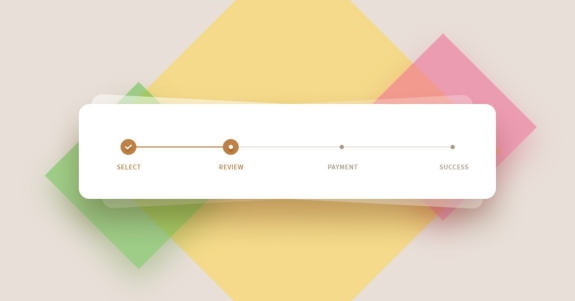

3. Provide a progress bar so customers know how many steps are left in the checkout process.

4. Include customer support information in case customers have any questions.

5. Offer coupon codes or discounts for completing the checkout process quickly.

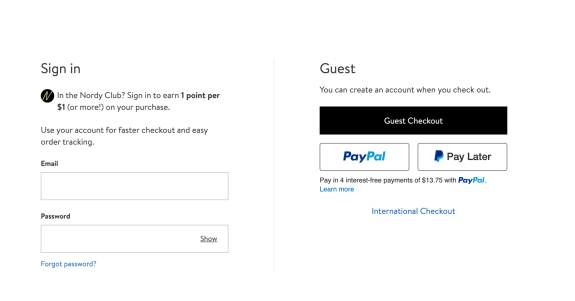

6. Offer checkout as guest option for customers so they don't need to create an account.

7. Have a mobile optimized checkout page.

8. Use customer testimonials or reviews, to build trust and reassure customers that they’re making a good decision.

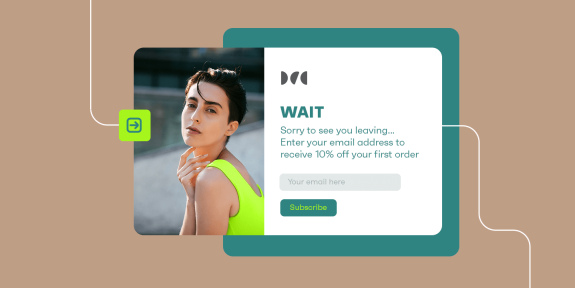

9. Use exit-intent popups to offer a last-minute discount or incentive to customers who are about to leave your site without checking out.

10. Always test your checkout process and make sure it's working properly

There are a number of checkout platforms available to businesses, each with their own set of features and benefits. To choose the right checkout platform and experience for your business, consider your needs and objectives, as well as the needs and preferences of your customers.

Core dna can help you build the checkout experience that converts with native integration with the best payment gateways in the market and offering an API-first environment.

Learn more about how to grow your eCommerce business below 👇

How to Optimize Your Payment Gateway Experience

Follow this steps to make sure your checkout process is optimized and increase your conversion rate.

- Eliminate unnecessary checkout steps: Streamline the checkout process by removing redundant fields and steps. The faster and easier it is for customers to pay, the higher your conversion rates.

- Offer multiple payment methods: (credit card, digital wallets, BNPL, ACH): Provide various payment options so customers can choose what works best for them. This flexibility caters to different regions and user preferences.

- Display security badges and trust signals: Visual trust indicators, like SSL badges and secure payment logos, reassure customers that their financial information is safe.

- Use a progress indicator during checkout: Clearly show customers where they are in the checkout process to reduce confusion and cart abandonment.

- Provide guest checkout: Don’t force account creation. Allow guest checkout to eliminate friction and speed up the process for first-time buyers.

- Optimize for mobile-first experiences: Ensure your payment gateway and checkout pages are fully responsive and load quickly on mobile devices.

- Show transparent shipping and tax costs upfront: Hidden costs are a top reason for cart abandonment. Be clear about all costs before the final checkout step.

- Offer live chat or customer support: Make help readily available during checkout to resolve questions or hesitations and prevent drop-offs.

- Deploy exit-intent popups for last-minute incentives: Offer discounts or free shipping to customers who show signs of leaving before completing their purchase.

- Continuously test and optimize your payment flows: Regularly review checkout analytics, run A/B tests, and gather customer feedback to refine the payment process and improve conversion rates.

Choosing the Right Payment Gateway for Your Business

Consider these factors:

Transaction volume

Target market (domestic vs. international)

Technical resources for integration

Business model (subscriptions, one-time sales, or both)

Preferred payment methods of your customers